Market Insights

After a strong rally in equity and bond markets in July, both sold off sharply again in August and September. Overall, developed market equities fell 6% (USD) over the quarter while global bonds fell 7% (USD) as they continue to be highly correlated to equity markets. The S&P 500 declined by -4.9% (USD) and the Nasdaq declined by -4.1% (USD) for the month of September. US markets fared relatively well earlier in September until the mid-month release of US August consumer price index (CPI) data triggered the biggest market sell-off since 2020. The rally in July was helped by markets starting to price in interest rate cuts from the Federal Reserve (Fed) in 2023, stoking hopes of a soft landing for the economy. However, in August, the Fed and other central banks reiterated at their Jackson Hole summit that their priority remains the fight against inflation rather than supporting growth. This was the primary driver of the sharp rise in bond yields and sell-off in equity markets in the second half of the quarter. To a large degree, it’s the same narrative as the first half of the year: stubbornly high inflation, aggressive Federal Reserve interest-rate policy, and a growing fear of recession. Bonds again offer no safety and stocks make a round trip in the bear market. Central banks are now in a race to tighten monetary policy and re-establish price stability.

After a strong rally in equity and bond markets in July, both sold off sharply again in August and September. Overall, developed market equities fell 6% (USD) over the quarter while global bonds fell 7% (USD) as they continue to be highly correlated to equity markets. The S&P 500 declined by -4.9% (USD) and the Nasdaq declined by -4.1% (USD) for the month of September. US markets fared relatively well earlier in September until the mid-month release of US August consumer price index (CPI) data triggered the biggest market sell-off since 2020. The rally in July was helped by markets starting to price in interest rate cuts from the Federal Reserve (Fed) in 2023, stoking hopes of a soft landing for the economy. However, in August, the Fed and other central banks reiterated at their Jackson Hole summit that their priority remains the fight against inflation rather than supporting growth. This was the primary driver of the sharp rise in bond yields and sell-off in equity markets in the second half of the quarter. To a large degree, it’s the same narrative as the first half of the year: stubbornly high inflation, aggressive Federal Reserve interest-rate policy, and a growing fear of recession. Bonds again offer no safety and stocks make a round trip in the bear market. Central banks are now in a race to tighten monetary policy and re-establish price stability.

In this environment, diversified bonds/equities portfolios have posted some of the weakest performance of the past decades. The U.S. dollar has benefited from Fed hawkishness and its safe-haven appeal during times of market volatility. In real trade-weighted terms, the U.S. dollar is the strongest since the mid-1980s. Overall, markets still appear to be expecting positive, but below potential growth, elevated but falling inflation and tight monetary policy. Global inflationary pressures moderated somewhat over the quarter on the back of lower oil and food prices. The WTI (West Texas Intermediary) oil price has dropped by nearly 30% since the start of July.

Overall, inflation is still expected to moderate in the coming months, but core inflation is expected to remain above the Fed’s target. That said, the Fed’s tighter monetary policy is already cooling down some parts of the economy, such as the housing market, as 30-year fixed mortgage rates have risen to well above 6%, their highest level since 2007. One positive, though, is that against a backdrop characterized by elevated inflation and slowing growth, global equity market valuations have now generally fallen below their 25-year averages.

Even in the US, the market is currently trading on a price-to-earnings (P/E) ratio of 15.6 vs. a long- term average of 16.6. It appears to us that the market has overcorrected to the downside. Growth stocks are the most undervalued, trading at a price/fair value of 0.75, followed by the value category trading at 0.77. Over the next six to 12 months, we expect that the markets will remain under pressure and volatility will remain high. To establish a bottom, the markets will need clarity as to when economic activity will make a meaningful and sustained rebound and evidence that inflation will begin to trend downward and return to the Fed’s 2% target.

Rising rates in the US and global markets pointing towards a major slowdown, and the war in Ukraine has caused the US dollar to appreciate against most major currencies. The dollar is up a record high of 17% against the British pound. The weakness of the pound was further aided by the UK government’s announcement of sweeping tax cuts funded by steep increases in government borrowing. It’s hard to find much good news, but one source of comfort is that investor sentiment is very negative, providing some reassurance that markets have already accounted for the bad news.

South Africa

South African equities fell in line with global peers over the quarter. The FTSE/JSE All Share Index fell -4.2% for the month and -1.4% for Q3. The Capped SWIX was down -3.8% and -2.4%, respectively. Leading the fall this year is industrials -16.8%, followed by resources -6.5% and financials, which shed -3.0% of their value. Capitec was the worst-performing major stock on the JSE declining by -24% for the month. The JSE All Bond Index managed to end the quarter on positive footing, up 0.6%. Listed property (JSE ALPI) extended losses, down -4.1% in Q3. Resources suffered from the fall in most commodity prices as investors started worrying about China’s zero covid policy and the impact on its economy. The Rand breached R18/US$ for the first time since May 2020, while also losing ground to the euro and Sterling. The manufacturing PMI slid back into contraction in September, coming in at 48.2, a drop from 52.1 in August. Incoming data suggests the SA economy likely entered a recession in Q3. Continued power outages, and a lack of business confidence and policy reform continue to hinder growth. South African inflation data, released during the month, came in slightly below expectations, with both core and headline inflation for August (+4.4% and 7.6%) coming in below the prior month’s levels. Despite an apparently softening inflation environment, the South African Reserve Bank (SARB) followed global central banks with a 0.75% rate hike.

All performance figures in ZAR unless otherwise stated.

View from Alpine Macro

Will inflation prove to be sticky as feared, or will disinflation be confirmed? We have firmly been on the disinflation camp and are therefore hopeful, nay committed, that the June lows in equity prices will hold. Of course, the market can easily break to new lows, but our conviction is that stocks will be higher in six months than they are today on falling inflation. Growth stocks have led the broad market into the bear phase. By the same token, they will likely lead other segments out of the bear market. With rate expectations still highly volatile, high-multiple stocks will continue to be depressed in the near term. However, if our view proves to be correct that inflation will fall quickly, growth stocks will likely outperform the benchmark in a sustainable recovery.

The Iza Portfolios

The Iza Global Equity Fund declined by -4.15%, while the Iza Global Balanced Fund declined by -4.21% and the Stable Model Portfolio declined by -4.41% (all GBP returns) for August.

Analysing our underlying fund managers, we find that Smithson Investment Trust was the fund’s biggest detractor declining -8.00% for the month. The top 5 detractors of Smithson were Sabre, Simcorp, Rightmove, Domino’s Pizza Enterprises and Temenos. Smithson has exited their position in Wingstop due to valuation concerns. Our funds largest holding Fundsmith, despite its relative defensive properties, ended the month down -4.5%. Fundsmith’s top 5 contributors in the month were Stryker, Pepsico, Paypal, Unilever and IDEXX. The top 5 detractors were Adobe, Estée Lauder, Microsoft, McCormick and Meta Platforms.

We continue our microscopic analysis of all holdings across the equity fund. Our solace lies in that the valuations remain attractive across the portfolio and are therefore maintained. As we continue to actively manage the Iza Global Balanced Fund we have bought a new position in BH Macro. BH Macro is a hedge to equities and bonds and their strongest performance has historically come at periods of market stress. We have also increased our holdings in structured products as given the environment having any kind of protection is a benefit. Looking ahead, Over the next six to 12 months, we expect that the markets will remain under pressure and volatility will remain high. October is historically the month when the downturn in the markets ends and begins. It is the month that starts the most buoyant period for risky assets

Funds’ Performance Summary

Market Insights

The S&P 500 reached a fresh low last week, closing -25% down from its January peak. While US equities may experience further downside, history suggests that those who stay the course have been rewarded. Historical drawdowns of 25% or more have delivered a forward one-year return of 27%, on average, with longer investment periods proving even more compelling. Timing the market bottom is difficult, but investors early to this recovery may see favorable returns over time. (Source: Goldman Sachs)

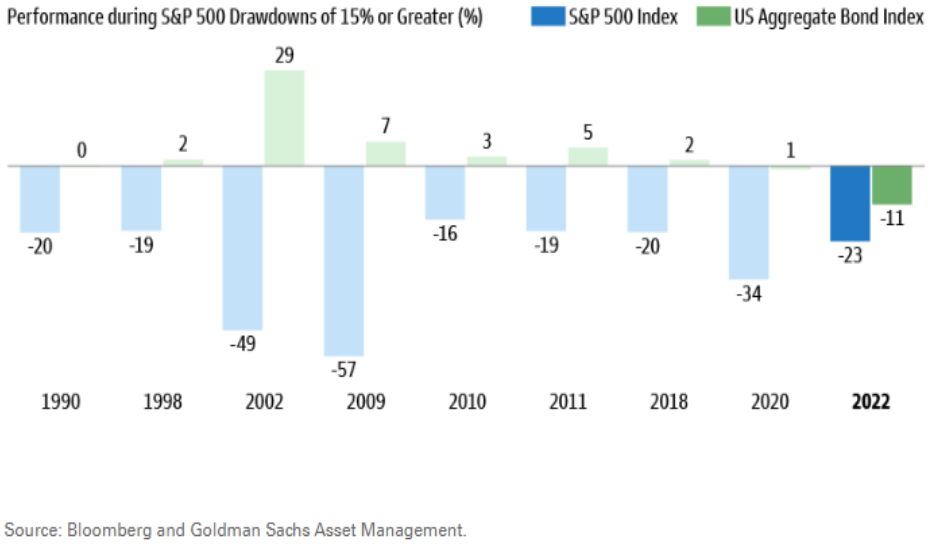

Equity contractions during past bear markets have usually been accompanied by fixed income boons, making bonds a diversifier for S&P 500 returns. This year, significant re-pricing has occurred alongside a complex macro setting, creating a headwind for all core assets. (Source: Goldman Sachs)

Asset Class Performance (Base Currency)