Market Insights

Global stocks retreated in February as the market re-evaluated the decreasing speed of inflation, and therefore the need for the FOMC to continue to increase interest rates and the time it needed to keep them higher. The S&P 500 declined by 2.61% (USD) in February and the Nasdaq composite declined 0.40% (USD) for the month. Large – cap Growth stocks were the top performers for February. The Russell 1000 Growth index fell 1.2% (USD) while the Russell 1000 Value index fell 3.5% (USD). Energy stocks were the worst performers of the month declining 7.1% (USD). February was a tough month for commodities, pressured by a strong USD, with the Dow Jones Commodity Index falling 4.9% (USD). UK equities held up well during the month. Large cap companies were among the top contributors and the FTSE 100 index achieved a new record high. After a strong performance in January, stocks retreated in February as economic data and comments from U.S. Federal Reserve officials prompted market participants to reconsider the odds the central bank would hike rates to a higher level than market forecasts and keep them elevated for longer than was initially expected. The month of February started off with the federal reserve raising the benchmark rate 25bps to 4.75%.

Global stocks retreated in February as the market re-evaluated the decreasing speed of inflation, and therefore the need for the FOMC to continue to increase interest rates and the time it needed to keep them higher. The S&P 500 declined by 2.61% (USD) in February and the Nasdaq composite declined 0.40% (USD) for the month. Large – cap Growth stocks were the top performers for February. The Russell 1000 Growth index fell 1.2% (USD) while the Russell 1000 Value index fell 3.5% (USD). Energy stocks were the worst performers of the month declining 7.1% (USD). February was a tough month for commodities, pressured by a strong USD, with the Dow Jones Commodity Index falling 4.9% (USD). UK equities held up well during the month. Large cap companies were among the top contributors and the FTSE 100 index achieved a new record high. After a strong performance in January, stocks retreated in February as economic data and comments from U.S. Federal Reserve officials prompted market participants to reconsider the odds the central bank would hike rates to a higher level than market forecasts and keep them elevated for longer than was initially expected. The month of February started off with the federal reserve raising the benchmark rate 25bps to 4.75%.

The market had been pricing in rate cuts in the back half of the year, but those expectations have largely disappeared with the assumption now that the Fed will keep rates higher for longer. The terminal rate has risen to 5.4%. The Federal Reserve (Fed) indicated that policy intervention was starting to work on curbing inflation, but that the policy rate may peak at a higher point. Economic data otherwise remains strong. Part of the move higher in rate expectations was the hot jobs number as the change in Nonfarm Payrolls came in +517k, substantially higher than the expected 189k. Inflation, as measured by the headline consumer price index (CPI), climbed 0.5% in January after a 0.1% increase in December; the pick-up was driven by the energy component.

Meanwhile, the prospect of rising US interest rates and higher inflation weighed on global debt markets, with the yield on the benchmark US 10-year Treasury note climbing 2.6%, to close the month at around 3.9%. The likelihood of a higher rate environment had the inverse effect on the US dollar, with the US Dollar Index (DXY) closing the month 2.7% higher. The likelihood of further rate hikes increased after the core personal consumption price index (PCE), the Fed’s preferred measure of inflation, rose by an annualized 4.7% in January, above market expectations of 4.3%.

Q4 GDP growth was revised down in the second reading, to a still-strong 2.7% (quarter-on-quarter, annualized). Housing prices continued to cool as mortgage rates jumped higher, while commodities continued their move lower. February also saw the second half of 4Q ’22 earnings prints. The market rewarded positive EPS surprises more than average while punishing negative surprises much less than average. Companies reporting positive EPS surprises have seen a price increase of 1.1% in the two days leading up to and two days following the print, which is above the 5-year average of 0.9%. On the flip side, negative surprises have resulted in a decrease of 0.6% compared to the 5-year average of -2.2%. To date 68% of S&P 500 companies reported positives EPS surprises which is below the 10-year average of 73%. 70% of companies have reported earnings growth, with an average growth of 5.6%.

In the UK, sentiment improved on the back of stronger-than-expected economic data. Annual inflation dropped to 10.1% in January, signaling the largest monthly decline since January 2019. In China, a strong run of economic data towards the end of the month helped support financial markets. Manufacturing (51.6), non-manufacturing (56.3) and services (55) PMIs all pointed to improvements in activity following the reopening of the economy.

South Africa

The local market posted negative returns in February as the country was ‘grey-listed’ by the Financial Action Task Force given deficiencies in its processes to combat money laundering and terrorist financing. The benchmark FTSE/JSE All Share Index lost -2.2% for the month, while the Capped SWIX fell -2.3% over the same period. The biggest detractor for the month was the miners as they declined 12% due to the weaker commodity prices. Financials and industrials gained 2.3% & 1.6% respectively. The FTSE/JSE All Bond Index declined by -0.9% for the month, while listed property (FTSE/JSE All Property Index) tracked -0.1% lower. On the economic front, South African January headline inflation eased to 6.9%, while core inflation (excluding the volatile food and energy components) was unchanged at 4.9%. The rand weakened by 5.5% against the US dollar, 2.7% against the euro and 2.9% relative to the pound sterling. The depreciation of the rand was largely due to the strong US dollar demand and a deteriorating economic outlook caused by the ongoing energy crisis. South Africa’s youth unemployment rate rose to 61% in 4Q22, up from a two-year low of 59.6% in the previous period. 1413 hours of load shedding have already occurred during 2023 – this equates to 37% of the total loadshedding hours endured during 2022.

All performance figures in ZAR unless otherwise stated.

View from Charlie Munger

Over the long term, it’s hard for a stock to earn a much better return than the business which underlies it earns. If the business earns six percent on capital over forty years and you hold it for

that forty years, you’re not going to make much different than a six percent return – even if you originally buy it at a huge

discount. Conversely, if a business earns eighteen percent on capital over twenty or thirty years, even if you pay an expensive looking price, you’ll end up with one hell of a result.

Charlie Munger, Vice-Chairman, Berkshire Hathaway

The Iza Portfolios

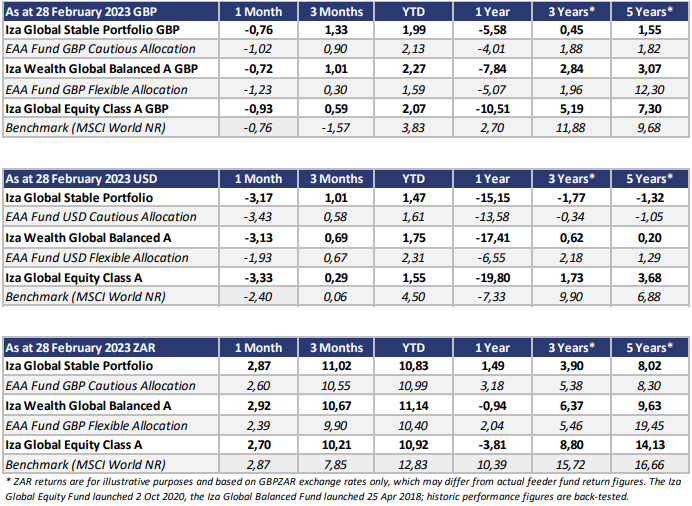

The Iza Global Equity Fund fell by 0.93% in February. while the Iza Global Balanced Fund declined by 0.72%. and the Stable Model Portfolio fell by 0.76% for the month (All GBP returns).

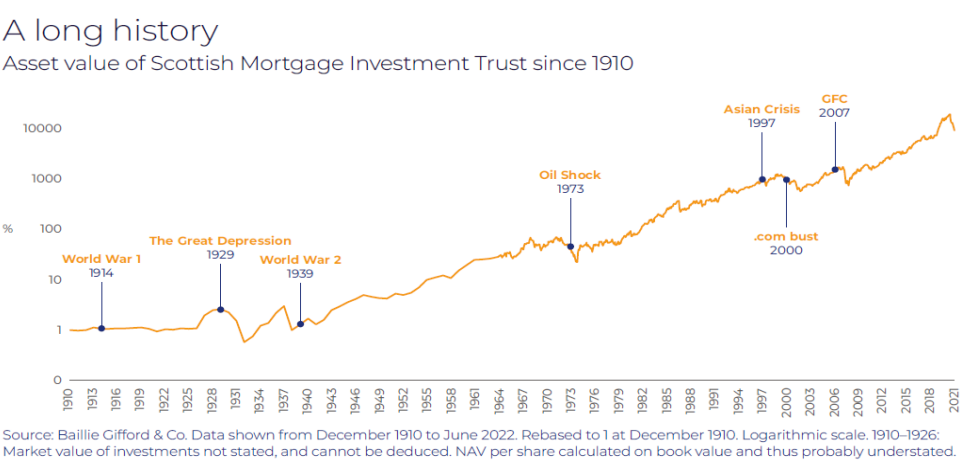

Looking at the underlying fund managers we find BH Macro made the largest contribution to the portfolio with a gain of 2.2% for the month. This highlights the diversification advantages of including BH Macro in the portfolio. Fundsmith Equity fund gained 1.5% for the month. Fundsmith’s top 5 contributors in the month were Meta Platforms, Novo Nordisk, Microsoft, Stryker and Pepsico. The top 5 detractors were Estée Lauder, Philip Morris, Alphabet, Amazon, and Nike. Scottish Mortgage fell 4.8% for the month. The Invesco Sterling Bond fund declined by 2.32% and the Royal London Sterling Extra Yield fund gained 0.28% for the month.

Smithson declined by 0.9% over the month. Smithson’s top 5 contributors in the month were Fortinet, Ambu, IPG Photonics, Addtech and Nemetschek. The top 5 detractors were Domino’s Pizza Enterprises, Sabre, Cognex, Verisign and Domino’s Pizza Group. The gold element of our portfolio declined by 3.05% for the month. Commodity markets lost ground in February, pressed by the prospect of rising borrowing costs, and reduced global demand.

Looking ahead into the month of March there are several significant events. One of them is the FOMC decision, scheduled on the 22nd. Moreover, the critical CPI release is due on the 14th.

Funds’ Performance Summary

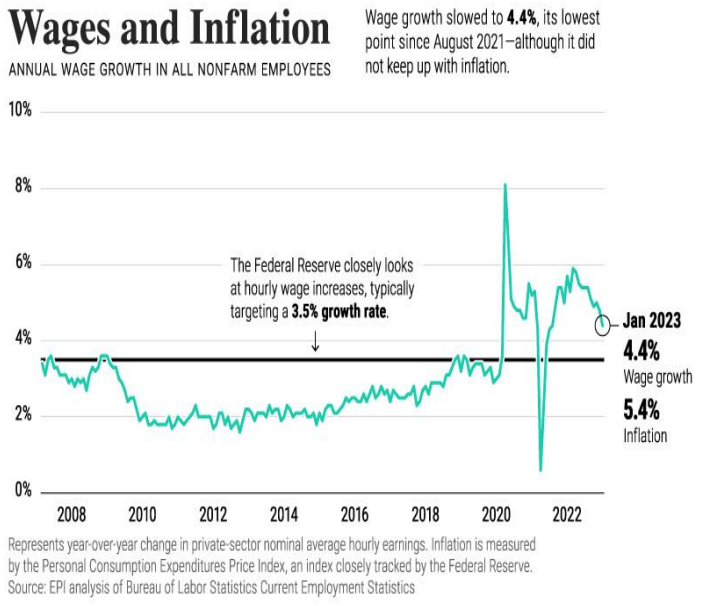

The current state of the job market shows a paradoxical situation: unemployment numbers have hit rock bottom, yet wage growth is slowing down. The latest report shows that annual wage growth in January fell to 4.4%, a decrease from the multi-decade high of 5.9% recorded in March of last year. However, wage growth is also falling below inflation by approximately 1%. The Federal Reserve is closely monitoring this situation as they typically set an annual wage growth target of 3.5% to maintain compatibility with a 2% inflation rate. In the current climate, this trend in wage growth has a dual effect. On one hand, the slowdown in wage growth may lead to workers struggling to keep up with inflation. On the other hand, slower wage growth could potentially help to prevent inflation from surging and keep interest rates from climbing higher.

Source: Visual Capitalist

Despite the prevailing macro and geopolitical uncertainties, the managers of Scottish Mortgage remain optimistic. As affirmed by Slater, “the underlying drumbeat of technological progress has not shifted; it’s getting stronger.”

That’s good news for Scottish Mortgage and its pursuit of exceptional growth companies. In the current environment, its long-term horizon gives it a better chance, the managers believe, of identifying companies making technological progress that have the potential to deliver strong long-term returns to Scottish Mortgage’s shareholders.

Source: Scottish Mortgage Investment Trust

Asset Class Performance (Base Currency)