Market Insights

Q1 2024 saw investors buoyed by encouraging economic data, marking a positive start to Spring. The US economy exceeded expectations in the last quarter of 2023, showing more growth than anticipated. Moreover, the composite Purchasing Managers’ Index (PMI) surveys demonstrated strong and continued expansion, elevating investor confidence. Globally, macroeconomic indicators mirrored this optimism, suggesting a gentle easing into economic stability rather than a hard landing.

Q1 2024 saw investors buoyed by encouraging economic data, marking a positive start to Spring. The US economy exceeded expectations in the last quarter of 2023, showing more growth than anticipated. Moreover, the composite Purchasing Managers’ Index (PMI) surveys demonstrated strong and continued expansion, elevating investor confidence. Globally, macroeconomic indicators mirrored this optimism, suggesting a gentle easing into economic stability rather than a hard landing.

Amidst this economic backdrop, global stock markets experienced gains. The World Index GBP rising by 8.73% in the first quarter, while market volatility stayed relatively subdued, with the VIX Index, a measure of stock market volatility, maintaining an average of about 14 throughout the period.

However, the narrative was different in the bond markets. Challenges arose from persistent inflation, robust economic activity, and the Federal Reserve’s slight shift from its previous lenient stance, resulting in bond market downturns. The changing economic environment led to adjusted market anticipations regarding US interest rate reductions, from expecting six to seven cuts by the end of 2023 to forecasting no more than three cuts beginning in the summer of 2024. The market’s expectations are now more aligned with the Federal Reserve’s projections. This adjustment, coupled with the Bloomberg Global Aggregate Index’s yield increase by 28 basis points, culminated in a -2.1% return for the quarter.

The quarter was particularly favorable for developed market stocks, especially growth-oriented ones, which saw a 10.3% return (USD). The US stood out with the S&P 500 climbing 10.6%, largely thanks to the exceptional earnings growth of its top seven companies. Japan topped performance charts with the Topix Index soaring 18.1% ( Yen ), even as the Bank of Japan initiated monetary policy normalization.

Although some European stock indexes, like the French CAC 40, hit new highs, Europe as a whole trailed behind the US and Japan. However, Europe ended the quarter positively, attracting investors looking away from the US market’s concentration risk, drawn by more attractive valuations and the narrowing economic growth gap with the US.

Emerging market equities didn’t fare as well, with the MSCI EM Index returning just 2.4% (USD), amid concerns over China’s economic growth without significant fiscal stimulus. However, the MSCI China Index recovered by 12.3% (Yuan) from its January trough, buoyed by improved economic activity around the Lunar New Year and policy easing by the People’s Bank of China.

The UK’s equity market struggled, with the FTSE All-Share Index up a mere 3.6% (GBP), impacted by its value-oriented market and the UK’s slide into a technical recession in the latter half of 2023.

In fixed income, the Bloomberg Global Aggregate Index saw a -2.1% decline last quarter as US inflation data heated up. European bonds, especially those from higher-yielding countries like Italy, fared better than German bonds, aiding European sovereign bonds in outperforming US Treasuries.

Credit markets saw high yield bonds outperforming investment-grade ones, benefiting from lower interest rate sensitivity and more favorable financial conditions. Both European and US high yield indices registered positive returns, whereas the Global Investment Grade Index declined.

Finally Real estate and other sectors sensitive to interest rate hikes felt the pinch as well, with the Global REITs Index declining by -1.5%. On the commodities front, the broad Bloomberg Commodity Index ticked up by 2.2%, driven by rising oil prices amidst ongoing supply constraints and geopolitical unrest, despite a drop in gas prices.

South Africa

March saw the local equity market outperform its major emerging market peers, with the FTSE/JSE Capped SWIX Index delivering 2.9% during the month. This positive performance helped claw back some of the year-to-date losses, although the index remains down 2.3% for 2024 at the end of the first quarter.

Globally, financial markets continued their strong run, seemingly unfazed by persistent inflationary pressures. Major economies displayed more resilience than initially anticipated, with global equities recording their 5th consecutive positive month and their 4th best opening quarter in three decades.

In South Africa, the inflation story was a cause for concern as local inflation data came in higher than expected, with core inflation jumping to 5% year-on-year. This rise, coupled with concerns about the country’s fiscal outlook and upcoming elections, led to a flight of foreign capital from the SA bond market. As a result, SA bonds suffered a second consecutive month of negative returns (-2.0%), with the 10-year yield rising by a significant 61 basis points.

The South African Reserve Bank (SARB) kept the repo rate unchanged at 8.25% in line with expectations. Despite a slight moderation in inflation expectations, the SARB maintained a hawkish stance, citing upside risks and high core inflation. This stance resulted in a revision to the inflation forecast, pushing the expected return to the target range of 4.5% to late 2025. Consequently, the number of projected rate cuts for 2024 was reduced from three to two.

The upcoming elections and the global economic slowdown pose potential challenges for the South African market. However, the recent resilience of the JSE and the potential for further easing in global interest rates later in the year offer reasons for cautious optimism. Investors should monitor inflation developments, policy decisions by the SARB, and global economic trends to make informed investment decisions.

The Iza Portfolios

During the first quarter of 2024, the Iza Global Balanced Fund and the Iza Global Equity Fund delivered impressive performances, underpinning their resilience and strategic foresight amid fluctuating market conditions. The Iza Global Balanced Fund achieved a notable ascent, registering a nearly 7% increase in GBP for the year, more than double the performance of its global peer group EAA GBP Flexible . This strong recovery the last few months means that the fund is not only top quartile over the short term but nearly back in the top 25% over 5 years. The Iza Global Equity Fund also made impressive strides, sneaking ahead of the overly concentrated MSCI World Index with an 8.74% gain. This outperformance was facilitated by a broadening of gains within the global equity space, highlighting both funds’ ability to leverage diversification across styles and jurisdictions to mitigate risk and enhance returns. The first quarter saw a mix of growth/quality names like Fundsmith, Nomura, and T. Rowe Price leading the way in January and February, while value-oriented Funds like Dodge and Cox surged in March, delivering over 5%. The strategic allocation to Scottish Mortgage Investment Trust paid off handsomely, with the trust announcing a stock buyback that propelled its share price upwards, culminating in an over 11% for March. This vindicated the investment thesis that sentiment has been a major headwind for Scottish Mortgage, alongside concerns about higher interest rates which are anticipated to resolve favourably in time. Despite a challenging quarter for bonds, which slightly detracted from the Balanced Fund’s overall performance, the fixed income allocation remains a critical hedge against potential slowdowns and market volatilities.

With yields ranging between 4.5% and 5%, bonds offer a prudent balance between income generation and protection against possible policy missteps by central banks. Moreover, gold emerged as a pivotal component of the Balanced Fund, surging over 8% in March as central banks intensified their acquisitions amid escalating geopolitical risks. This performance came despite the backdrop of higher real yields and a marginally stronger dollar, suggesting gold’s potential for further gains driven by retail investor demand and a softening dollar. As the year commenced, investors witnessed a concentration of gains in large-cap growth stocks, raising valuations in the equity markets amid global economic resilience. While potential rate cuts later in the year may support this trend, there’s a growing sense that some markets may have reached an overly optimistic valuation, posing risks for future profit-taking. In the face of economic, environmental, political, and geopolitical uncertainties, the importance of maintaining a diversified and resilient portfolio becomes paramount. The Iza Funds have adeptly navigated these challenges, particularly within the Balanced Fund, leveraging a broad spectrum of investment options for diversification. With fixed income markets appearing more reasonably priced, they offer a safeguard against potential downturns, while equities—especially those outside the high-flying large-cap tech sector—present opportunities for sustainable portfolio growth. Notably, investment trusts like Scottish Mortgage and Smithson have started to close the gap to their net asset values, highlighting potential opportunities for investors seeking durability and value in their investments.

Quote

In investing, what is comfortable is rarely profitable.

Robert Arnott

Funds’ Performance Summary

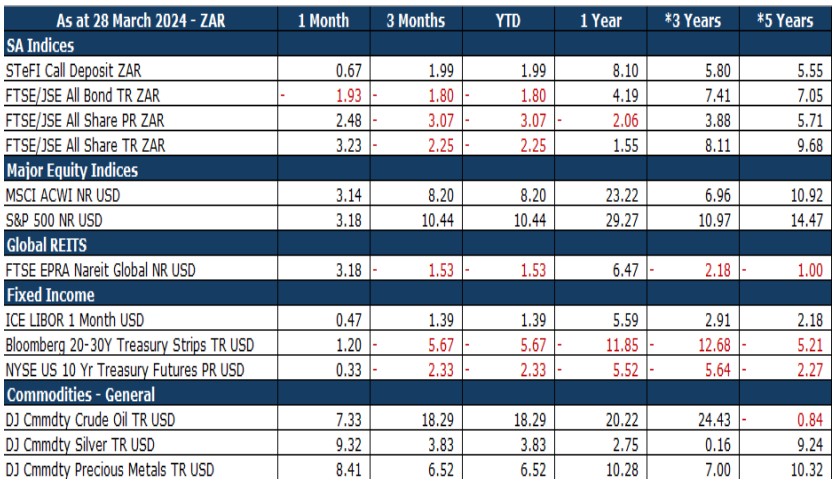

Asset Class Performance (Base Currency)