Global Market Overview

In February, the coronavirus (COVID-19) outbreak replaced trade as the main focus for the markets. Fears of near-term negative effects on Chinese and global growth, together with the expectation that central banks around the globe will provide further monetary policy support, sent core government bond yields lower throughout the month. By the end of the month, the US 10-year Treasury yield stood at a new all-time low of 1.1%, 2.1% points below the recent peak in October 2018.

In the first couple of weeks of February, equity markets shrugged off concerns about the outbreak, supported by a better-than-expected US Q4 earnings season, improving business surveys for January, and the expectation that negative effects of the coronavirus would be temporary and localised. However, the increase in cases outside China led to a sharp selloff towards the end of the month. Developed market equites fell sharply, with the S&P 500 ending the month down 8.2%. From a regional perspective, emerging market equities outperformed developed markets, despite the fact that most COVID-19 infections are currently in Asia, as investors factored in declining rates of new infection in China compared with increasing infections outside China.

Risk aversion also spread into commodities. The WTI oil price fell 13%, adding to the steep fall in January and bringing the total year-to-date decline to 27%. The biggest headwinds came from concerns about the first decline in global oil demand since 2009, due to the economic disruptions caused by the COVID-19 outbreak, together with stalling negotiations between Russia and OPEC on the implementation of further supply cuts. An oil price below USD 50 is sending a disinflationary impulse into the world economy, giving central banks room for supportive measures.

United States

Macro data in the US proved a mixed bag for investors in February. Low mortgage rates continue to fuel activity in the housing market. Housing starts and permits beat expectations and home price momentum is still positive. The January employment report revealed a healthy labour market, with solid job gains and workers joining the labour force. Total payroll employment rose by 225,000, well above consensus expectations of 160,000.

The latest job openings figures were also weak. Job openings declined by 5.4% month on month and were down 14% y/y. While the decline is potentially a concern, we have to keep in mind that the overall level of job openings is still higher than the high of the previous cycle, and jobless claims remain low. However, the flash purchasing managers’ indices (PMIs) in February showed that the COVID-19 outbreak is beginning to impact US sentiment. The fall of the composite PMI below 50 is of potential concern since it shows that the souring in business sentiment is broad- based.

While recent hard macro data indicates that the US economy remains healthy, the survey data suggests downside risks to growth if COVID-19 can’t be contained. This makes further monetary stimulus by the Federal Reserve more likely in the coming months. Markets are now pricing three further cuts this year.

In the battle for the Democratic nomination, Bernie Sanders took the lead after a strong showing in the first three primaries. Therefore the odds of a progressive Democratic nominee increased substantially in February.

UK

UK economic sentiment continued to improve in February, with both consumer and business sentiment picking up. While the recent spread of COVID-19 across Europe looks increasingly likely to affect confidence and activity, there is little evidence yet in the data of the effect of the outbreak on the UK economy. Job growth continued its recent upswing with a solid 180k gain in the three months to December. The unemployment rate remained at 3.8%, the lowest level since 1975.

The UK government and the EU also published their respective directives for the post-Brexit trade negotiations, which will start in March and could prove bumpy.

Eurozone

Although December data, released in February, confirmed that the eurozone economy ended 2019 on a weak note, the survey data looked more promising. The eurozone composite PMI rose 0.3 points to 51.6 in February, which is consistent with trend GDP growth. This reflects a fading of multiple drags, including the trade war, Brexit uncertainty, the emissions scandal in the automobile industry and the sharp inventory correction. The improvement was also reflected in German manufacturing in January. However, the February flash PMI details in Germany and the euro area already showed a significant impact from the coronavirus outbreak, with sharp declines in the PMI sub-component for export orders, and a sudden lengthening of delivery times. These virus-related drags are likely to intensify further in March as the COVID-19 outbreak in Italy and around the world disrupts production. The globally integrated European economy is particularly vulnerable to global supply chain disruptions, posing downside risks to growth. If the situation deteriorates further in the coming months, fiscal measures can be expected. Even Germany is allowed to breach its constitutional spending limits in the event of a crisis.

South Africa

Local markets took direction from abroad amidst the escalation of the Coronavirus, with risk assets such as local equities and property being sold down aggressively. The weakness of the local economy that’s experienced a wave on ongoing power cuts in recent months compounded the sell-off, thanks to the absence of liquidity outside of the Top 40 . The lack of confidence in the local market is evident on so many levels, but for once the problem was not our own, as most emerging markets felt the brunt of the global sell-off. In US$ terms, South African equities fell 13.2% in February, performing line with our peers such as Brazil, Turkey and Russia.

Despite a relatively upbeat budget (which we’ll touch on in just a bit), the rand weakened by 4.2% against the US$, the JSE All Share Index fell 9% in rand terms, and local bonds ended the month marginally down. In rand terms the All Share Index lost Listed property was the worst performing sector, falling 15.7% in the month, despite the heightened chance of rate cuts in SA and abroad.

Of course, the underperformance of SA property market was evident before the widespread panic kicked in, with some companies in this sector reporting lackluster results earlier in the year. Take Redefine for example, who expects a fall in distributable earnings of between 5 and 7% in the coming year. Broadly speaking, the sector remains under severe pressure, with waning demand for physical retail space (a theme playing out globally as well), a weak consumer environment, and an excess in retail and office space. One should not forget the impact of load-shedding on the margins of the retail centric companies, as they either need to foot the bill for generators to keep the lights on or experience a loss in foot traffic. Furthermore, in recent years, operational expenditure has ballooned for companies in this sector thanks to rising water and electricity costs, as well as escalating municipal rates. The highly geared nature of the sector, together with poor fundamental prospects in the short to medium term certainly warrants some caution.

SA Budget

In recent years, the market has become somewhat used to the lack of urgency required by Treasury to dig itself out of the hole created by years of maladministration, corruption and absence of sound leadership. The ever-increasing tax burden that has fallen on a shrinking base has sparked a wave of discontent and lack of confidence, especially considering government’s inability to pull in their own purse strings. The uncontrollable expansion of the public sector wage bill is a prime example of this, so is the ineffectiveness of government’s ability to deal with failing SOE’s, both of which are at the heart of the problem.

Expectations leading up to the Budget speech were pretty low, especially after the frightening Medium-Term Budget Policy Statement (MTBPS) late last year. In earnest, many market participants felt that the MTBPS outlined a “worst-case scenario” and the performance of the Rand and local bonds on that day reflect that, both of which fell significantly. It wasn’t easy to be optimistic leading up to the 2020 Budget, but Minister Mboweni surprised us all with a relatively market friendly speech.

Even though the local economy finds itself on the verge a technical recession, with a mounting debt burden and the heightened risk of a downgrade to junk status by Moody’s, Treasury achieved the seemingly improbable in delivering some pro-active growth measures. For example, following successive years of increases personal income tax, individuals have finally been offered some relief with marginal personal income tax cuts. Spending will also be reprioritized with an emphasis on fixed investment and key intuitions such as SARS, to promote growth and improve revenue collection.

The proposal to cut the public sector wage bill by R160bn (or 3% of GDP) in aggregate is also a key feature that came as a surprise to most, mostly because of the political implications should government lose favour with Cosatu and other major unions. It’s a cunning plan and government will have their work cut out for them, especially because the first year is still under 2018 wage settlement agreements. Unions are making a lot of noise about the proposed spending cuts (as one would expect), however it’s hard to believe that union leaders weren’t consulted beforehand.

The budget was well received by the market, and while it is generally accepted to be credible, we are aware that it is susceptible to execution risk. For now, one can be thankful that Treasury is on a better path today than it was a year ago, with a lower likelihood of a downgrade by Moodys (at least in the short term), thanks to some unpopular yet necessary decisions. The reprioritization of spending and efforts to broaden the tax base could provide an improvement to investor sentiment if executed correctly. It also opens the door to for the Reserve Bank to run looser monetary policy which could improve the probability of an economic recovery down the line.

As Carmen Nel from Matrix Fund Managers put it:

“National Treasury effectively acknowledges the fact that our structural spending is too high relative to our structural economic and revenue growth and that the composition of spending is not productivity enhancing. The government needs to implement policies that will lower structural spending, increase structural growth.”

For now, heightened risk in global financial markets will override the good news received in the budget, but when things settle down, local bonds and SA equities have reason to cheer.

Conclusion

Measures to contain the coronavirus have disrupted manufacturing supply chains and induced a supply shock across broad parts of Asia. The latest country to be severely hit is Italy, which has introduced dramatic containment measures nation-wide. These supply shocks are now being followed by demand shocks as consumption of goods and services is reduced. To make matters worse, global growth is being hit by a third shock: the disagreement between Saudi Arabia and Russia on production cuts sent oil prices on a downward spiral, falling by 25% in a single day – the largest drop since 1990. While the lower oil price will eventually be good for consumers, it is negative for European and American oil producers, and can negatively impact credit markets as well. Acknowledging the uncertainties related to the spread of the virus, however, we do expect that Europe and the USA will eventually be able to contain the outbreak in a way that avoids pushing the global economy into an protracted outright recession. This should allow equities to regain lost ground as confidence is slowly restored over the next 3 to 6 months. Attention should then shift back to fundamentals such as equities’ attractive dividend yield, especially compared to sharply fallen bond yields. Nearer term, weaker economic indicators and rising numbers of infections are likely to continue to weigh on sentiment, competing with likely upcoming monetary and fiscal policy measures to determine market direction. As mentioned, we think that politicians still have to catch up with the challenges ahead. We thus prefer a neutral equity allocation in portfolios at this juncture.

Overall, we believe investors may benefit from maintaining a balanced approach to asset allocation given the uncertain nature of the COVID-19 outbreak. Risk aversion could prevail if more countries see the number of cases rise in the weeks ahead. Within equities, defensive sectors have the potential to outperform if the outlook deteriorates. Hedges such as gold and bonds will continue to offer diversification during bouts of weakness but long term the latter is looking far less attractive, especially if this does prove more transitory.

Fund and Portfolios Overview

The portfolios were not immune to the rapid sell off in risk assets, however names like Scottish Mortgage (SMT) outperformed associated equity benchmarks and diversifiers in the form of gold and inflation linked bonds ( PIMCO) both delivered over 2%. After a significant rally in SMT we took some profits ahead of the sell off and rebalanced the position back to target for the Flexible portfolio. Flat performance from Rubrics and Structured Notes also diluted some of harsh market action along with strength in the USD as investors flocked to safe-haven assets. Given the sharp reduction in rates to 1.1% on the US10 YR we decided to take profits on the 5% exposure to PIMCO and will take this up once again should rates normalise. This was also seen as a way of capitalising on investor overreaction as opposed to trying to time the bottom in equities. Dry powder has been created to deploy into attractive opportunities post the sell off. Markets like China are looking very attractive with a talented manager lined up to capitalise on these opportunities. China’s quick response to the virus and massive stimulatory effort could see it continue to outperform going forward.

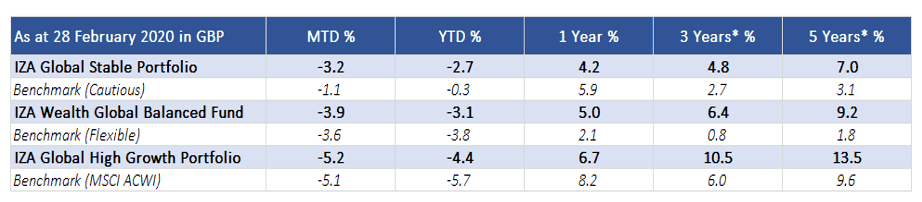

Funds’ Performance Summary (GBP)

Asset Class Performance (Base Currency)