Market Insights

Global markets rallied in November, with U.S. equities leading the way. Domestically focused small-cap stocks surged on optimism around Trump’s pro-growth policies, while large-cap equities also gained on expectations of fiscal stimulus and deregulation. However, the strong dollar created challenges for emerging markets and export-oriented sectors in developed markets.

Global markets rallied in November, with U.S. equities leading the way. Domestically focused small-cap stocks surged on optimism around Trump’s pro-growth policies, while large-cap equities also gained on expectations of fiscal stimulus and deregulation. However, the strong dollar created challenges for emerging markets and export-oriented sectors in developed markets.

Fixed income markets showed mixed results, with U.S. Treasuries stabilizing as yields edged lower. High-yield bonds outperformed, reflecting optimism about business-friendly policies under the new administration. Commodities had a challenging month, with gold and silver retreating amid profit-taking and the stronger dollar, while industrial metals were mixed.

November 2024 was marked by strong market movements following Donald Trump’s re-election as U.S. President. Expectations of pro-growth policies, including tax cuts, deregulation, and fiscal expansion, buoyed U.S. equities and strengthened the U.S. dollar against all major currencies. Both the Iza Global Balanced and Iza Global Equity Funds navigated this environment with strategic adjustments to USD exposure. While the currency has played a role in some relative underperformance both funds continue to outperform their respective peers year-to-date.

In anticipation of the dollar’s strength, we proactively increased USD exposure across both funds in October and continued the process into November by rotating out of GBP-hedged classes into USD-denominated versions of holdings, such as the Nomura Global High Conviction Fund, MSCI World ETF, and iShares US Bond ETF. While the recent USD surge has detracted slightly from performance on a relative basis over the past two months, these adjustments have brought the funds’ currency exposure more in line with global peers. We remain vigilant, monitoring key drivers, including Trump’s unfolding policies, to ensure our positioning remains aligned with long-term objectives.

November highlighted the importance of proactive portfolio management and currency strategy. Both the Iza Global Balanced and Equity Funds benefitted from timely adjustments to USD exposure, ensuring alignment with global market dynamics. While the recent strength of the USD has posed challenges, our strategic adjustments have achieved exposure more in line with global peers, positioning the funds for future opportunities.

The Balanced Fund’s diversified positioning, including Berkshire Hathaway, Scottish Mortgage, and Guinness, underscored its resilience in a volatile month. Meanwhile, the Equity Fund’s strategic additions, such as the GARP ETF and reduced reliance on hedged classes, allowed it to capture gains in U.S. small- and mid-caps, while Scottish Mortgage and Berkshire further enhanced performance.

Looking ahead, we will monitor the evolving landscape closely, particularly Trump’s fiscal and deregulation policies, to ensure the funds remain aligned with their objectives. The balanced approach between growth, quality, and defensive holdings ensures continued potential for strong performance amid changing market conditions.

South Africa

Developed market equities performed strongly in November (+4.8%), with the US leading the way (+7.7%) driven by the “Trump trade.” Emerging market equities, however, experienced a second consecutive monthly decline (-2.8%), largely attributed to concerns over protectionist trade policies from the incoming US administration.

Given this backdrop it wasn’t a surprise to see SA equities on the backfoot for a second consecutive month (-0.9%). Besides the headwind for EM regions related to the outcome of the US election, weakness in investment companies Naspers and Prosus (-2%) and the mining sector (-7%) were major detractors for the local bourse.

Conversely, domestically focused companies (“SA Inc. stocks”) showed a slight positive return (+0.8%). Several companies reported strong results, boosting their share prices. WeBuyCars, a recent JSE listing, was a top performer (+26%) due to exceeding FY24 expectations.

South African equities (-0.9%) outperformed the broader emerging market composite despite the negative month. Within SA equities, the retail sector performed exceptionally well (+7.1%), boosted by improved real disposable income and Two Pot withdrawals.

The SA 10-year government borrowing rate decreased by 0.4% per annum to 10.2% per annum, reflecting a broader global trend of lower bond yields. SA bonds demonstrated continued strength (+3%), driven by strong domestic demand due to lower inflation, a reduced repo rate, improved fiscal prospects, and seasonal factors.

The rand weakened against the US dollar (-2.5%), despite remaining a relatively strong performer amongst major currencies in 2024.

In conclusion, November showed mixed results for South African asset classes. While equities declined overall, the domestic economy demonstrated strength, and several companies performed exceptionally well. Bonds benefited from positive domestic factors and global trends. The SARB’s rate cut reflected a benign inflationary environment, while the economic outlook remains cautiously optimistic. The rand’s performance against the USD warrants close monitoring. Investors should consider these factors when making investment decisions.

All performance figures in ZAR unless otherwise stated.

The Iza Portfolios

IZA Global Balanced Fund

The Iza Global Balanced Fund benefitted from its diversified holdings, particularly Equities and Bonds in November while gold took a breather after a strong run this year so far. Berkshire Hathaway was a standout performer, delivering an 8% return in GBP terms. Berkshire’s year-to-date performance is on track to be its best in 25 years, driven by strong operating results and a resilient portfolio of businesses.

Scottish Mortgage Investment Trust also delivered a strong 8% return in GBP terms. The trust benefitted from a narrowing of the discount between its net asset value and market price. Additionally, news surrounding SpaceX, its third-largest holding, provided a significant boost. SpaceX was valued at over $300 billion in a recent tender offer, further supporting the trust’s performance and underscoring the importance of its exposure to innovative private companies.

Gold, which has been a consistent contributor throughout the year, suffered some losses in November, declining slightly due to profit-taking and a stronger dollar. Despite this, the fund capitalized on earlier gains, having rebalanced its gold holdings in October there mitigating some of the recent sell off. Bonds delivered a positive number for November having suffered in October and into the election only to rebound into the close of November and end the month in the green, thereby contributing positively to performance.

The fund’s full exit from Fundsmith Equity Fund was completed during the month, replaced by Guinness Global Equity Income Fund. Guinness has already shown positive contributions, emphasizing its focus on quality stocks with growing dividends. The fund’s cautious yet proactive approach to portfolio adjustments ensures continued alignment with evolving market conditions.

IZA Global Equity Fund

The Iza Global Equity Fund also navigated November effectively, benefitting from the strategic addition of the S&P Midcap 400 GARP ETF, which replaced Smithson last month. The GARP ETF surged 10% in GBP terms during the month, driven by the Trump win and the subsequent rally in U.S. small- and mid-cap stocks. This validates the decision to rotate out of Smithson, ensuring the fund captures growth at a reasonable valuation while avoiding potential headwinds in the smallest-cap segment.

Scottish Mortgage Investment Trust was another standout, delivering an 8% return in GBP terms, reflecting its resilience amid a volatile market. The trust benefitted from the closing valuation gap between its net asset value and market price. SpaceX, a major holding, garnered attention with a tender offer that valued the company at over $3 billion, further boosting sentiment.

Berkshire Hathaway mirrored its strong performance in the Balanced Fund, reinforcing its role as a key contributor to the Equity Fund’s success. The newly added Guinness Global Equity Income Fund performed well, showing early signs of delivering consistent returns, while the MSCI World ETF maintained stability, benefitting from increased USD exposure. Clearance Camino, the European property-focused addition, faced headwinds due to rising rates and weaker EUR, though we believe this is a short-term reaction to broader macro trends.

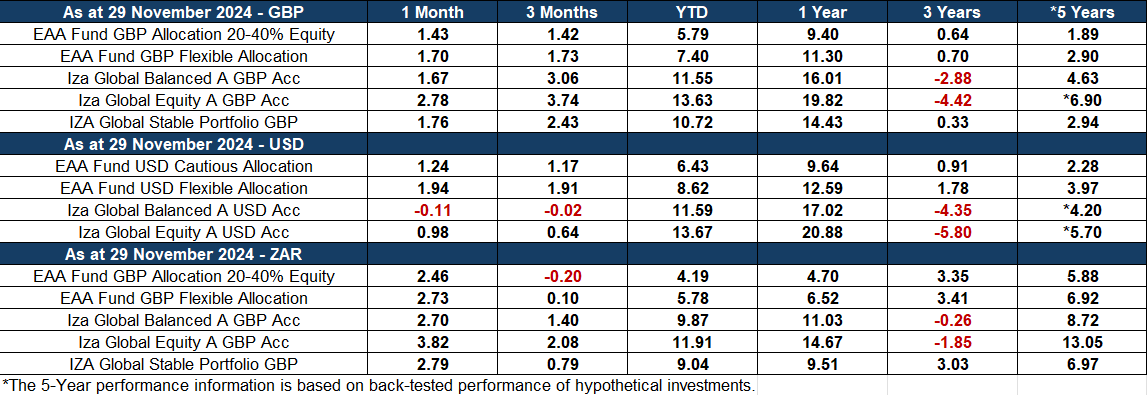

Asset Class Performance (Base Currency)