Market Insights

January 2025 marks a promising start to the year, with the Iza Balanced and Equity Funds delivering strong results driven by strategic asset allocation and exceptional alpha from our active managers. As we continue to see the benefits of increased USD exposure following the dollar’s recent strength in Feb and we are well-positioned for further upside.

January 2025 marks a promising start to the year, with the Iza Balanced and Equity Funds delivering strong results driven by strategic asset allocation and exceptional alpha from our active managers. As we continue to see the benefits of increased USD exposure following the dollar’s recent strength in Feb and we are well-positioned for further upside.

The market is showing clear signs of broadening beyond its previous concentration in U.S. mega-cap tech, creating a more favourable environment for our diversified portfolios. The success of our high-conviction managers, combined with our flexible asset allocation strategy, underscores our confidence in the ability of both funds to continue outperforming benchmarks and peers. As we move further into 2025, we remain optimistic that this carefully constructed approach will deliver long-term growth and resilience amid an ever-evolving market landscape.

The Iza Balanced and Equity Funds started 2025 on a strong note, outperforming their respective benchmarks and peers. The Balanced Fund exceeded the EAA Global Flex GBP benchmark by 2%, while the Equity Fund outperformed both the ASISA Global Equity peer group and the MSCI World Index by more than 1%. These results highlight the importance of our disciplined, multi-faceted investment approach, combining strategic asset allocation with high-conviction manager selection. A key driver of January’s outperformance was the significant alpha generated by our selected active managers across growth, value, and quality styles, each delivering double to triple the returns of major U.S. benchmarks like the S&P 500 and Nasdaq.

Our long-standing investment process is focused not only on selecting managers that outperform their respective benchmarks (such as the MSCI World Index) but also on ensuring they consistently deliver superior performance compared to their peers within the same style through different market cycles. Even in periods when market cap-weighted indexes dominate, our careful manager selection ensures that we’re well-positioned for long-term outperformance. January’s results provide clear validation of this strategy as we begin to see a broadening market recovery beyond large-cap U.S. tech.

Our disciplined process remains central to delivering sustained long-term outperformance. By spending extensive time identifying high-quality active managers, we ensure not only their ability to outperform benchmarks like the MSCI World Index but also to consistently deliver better returns than their peers within the same style. This process involves rigorous analysis of each manager’s strategy, performance history, and adaptability across various market environments.

January’s performance reflects the strength of this approach, with growth-focused managers like T. Rowe and Scottish Mortgage leading gains, value-oriented managers like Dodge & Cox capitalizing on sector rotations, and quality-focused managers like Nomura continuing to deliver steady performance. As markets broaden, we expect this diversification to remain a key driver of sustained alpha.

South Africa

2025 kicked off to a bumpy start for local markets as fears of US tariffs gripped emerging markets. The return of the All Share Index (+2.3%) doesn’t quite reflect the sombre mood in the market unless you look at the performance of domestics, like retailers, insurers and banks. The main reason behind the relative robust performance of the ALSI comes down to the strong performance of resources, in particular the gold and down beaten platinum miners, and then the strong performance of certain stocks driven by positive news flow such as Richemont, MTN and Vodacom.

Luxury conglomerate Richemont showed remarkable growth with a 31% month-over-month increase in its stock price. This impressive performance was driven by a strong trading update that revealed a 10% year-over-year revenue growth for the most recent quarter. This growth surpassed market expectations, which had anticipated only a 1% increase. The company’s success might be attributed to strong demand for luxury goods, possibly fuelled by a recovering global economy and increased consumer spending in key markets.

SA Telecoms also experienced positive momentum, with MTN’s stock rising by 25% and Vodacom’s by 8% month-over-month. A significant factor for MTN’s surge was the decision by Nigerian regulators to implement supportive tariff hikes, which enhanced its revenue prospects in one of its most crucial markets. Vodacom likely benefited from this positive sentiment towards the broader telecom sector and potentially favourable regulatory environments in other key regions.

In contrast, shares linked to the domestic economy faced a minor setback in January, recording a 2% decline. This pullback may be seen as a natural correction following a robust performance in 2024, potentially driven by market consolidation and investors reassessing domestic economic conditions.

Investment firms Naspers and Prosus were also under pressure, with their stock prices falling by 6% month-over-month. This decline coincided with a similar decrease in Tencent’s valuation in rand terms. The downturn was exacerbated by the U.S. government designating Tencent as a Chinese military company, which raised concerns over potential sanctions and restrictions impacting its operations and profitability. This designation may have caused investors to reassess the risk associated with investments in Tencent, consequently affecting Naspers and Prosus due to their substantial stakes in the Chinese tech giant.

In fixed income and currency markets, SA bonds (+0.4%) and the rand (vs US$) came under pressure in the first 2 weeks of the month as investor sentiment towards EM turned negative. Subsequently bonds and the currency rallied as the new US administration was less aggressive than initially expected. The last week of the month saw a spike in volatility as concerns around the GNU’s sustainability and the return of load shedding resulted in marginally higher yields and a weaker currency.

On the economic front, the Monetary Policy Committee (MPC) of the SARB reduced the repo rate by 25 basis points to 7.5%, aligning with market expectations, although the decision was split, with two members advocating for no change. Despite the recent lower inflation figures (+3% YoY), both the split decision and the MPC’s statement carried a hawkish undertone. The Governor began his address by noting that the MPC had previously cautioned about a more difficult global environment, and some of the risks identified have since come to pass, particularly regarding changes in the U.S. monetary policy outlook.

Comments from MPC members during the post-decision investor briefing indicated that the U.S. Fed’s decision made the previous night did not have an impact on the SARB’s rate decision. The SARB’s economic forecasts remained largely unchanged, as the unexpectedly favourable inflation data over recent months was offset by a weaker currency than previously assumed.

Economic data released recently remained mixed, pointing to a modest recovery from the third quarter. Forward looking indicators are also mixed with the ABSA PMI and S&P SA PMI declining to 46.2 and 49.9, respectively. However, the SARB’s Business Cycle Leading Indicator, increased for the third consecutive month implying improving growth momentum in the quarters ahead.

All performance figures in ZAR unless otherwise stated.

The Iza Portfolios

IZA Global Balanced Fund

The Balanced Fund’s January gains were broad-based, benefiting from strong equity performance and non-equity contributions from gold and fixed income. The fund’s strategic allocation, combining growth, value, and quality exposures, contributed to its notable outperformance.

Top Contributors:

- Scottish Mortgage Investment Trust (+13.66% GBP): One of the standout performers for the month, driven by its significant exposure to Amazon and Meta, both of which delivered strong gains as they continued to outperform their MAG 7 peers. Amazon surged on the back of better-than-expected retail and cloud earnings, while Meta benefited from cost-cutting measures and growth in its AI-driven advertising segment. Additionally, Scottish Mortgage’s NAV discount narrowed as investor sentiment improved, further boosting returns.

- T. Rowe Price Global Focused Growth (+6.74% GBP): Delivered outstanding performance, significantly outperforming the MSCI World Index and tripling the returns of the S&P 500 and Nasdaq. The fund’s diversified growth exposure in Europe and Asia proved particularly effective, reinforcing the importance of global diversification.

- Berkshire Hathaway (+4.4% GBP): Continued its strong run, with gains driven by strength in its key holdings and cash-generative businesses, underscoring the role of value-oriented exposure during periods of market rotation.

Non-Equity Contributions:

- SPDR Gold Trust (+7.83% GBP): Gold’s surge to new highs, driven by geopolitical tensions and increased safe-haven demand, contributed significantly to the Balanced Fund’s performance.

- iShares 7-10 Year Treasury Bond ETF (+1.6% GBP): Bonds provided stability amid January’s market volatility, as yields reversed mid-month following a weaker-than-expected inflation report and tech-related volatility.

The Balanced Fund also benefited from the strategic rebalancing of USD exposure, initiated in late 2024, positioning the portfolio to capture gains as the dollar strengthened again in February following Trump’s tariff announcements.

IZA Global Equity Fund

The Iza Equity Fund’s January outperformance was driven by exceptional contributions from high-conviction active managers across growth, value, and quality strategies, each delivering alpha well beyond the MSCI World and U.S. benchmarks.

Top Contributors:

- Scottish Mortgage Investment Trust (+13.66% GBP): A key contributor to the fund’s success, driven by Amazon and Meta, which both rank among Scottish’s top 5 holdings. Amazon’s exceptional earnings, coupled with Meta’s improved profitability and AI-driven advertising growth, powered gains that outpaced other MAG 7 stocks like Nvidia and Tesla. Investor enthusiasm over Scottish’s concentrated exposure to future-facing companies like SpaceX, which saw a valuation boost, further amplified its performance.

- T. Rowe Price Global Focused Growth (+6.74% GBP): Demonstrated its strength by more than tripling the returns of the S&P 500 and significantly outperforming the MSCI World Index. Its exposure to emerging growth sectors outside of U.S. mega-cap tech proved highly effective.

- Nomura Global High Conviction (+5.53% GBP): The fund’s disciplined stock selection in defensive sectors like consumer staples and healthcare provided steady gains, delivering strong returns in line with our expectations for quality-focused managers.

- Dodge & Cox Worldwide Global Stock Fund (+6.76% GBP): Benefited from its value-oriented positioning, with financials and industrials leading the charge. Trump’s pro-business policies and infrastructure spending announcements provided additional tailwinds.

The recently added Invesco S&P MidCap 400 GARP ETF also contributed positively, as mid-cap stocks continued to rally, supported by improving sentiment and broadening market participation.

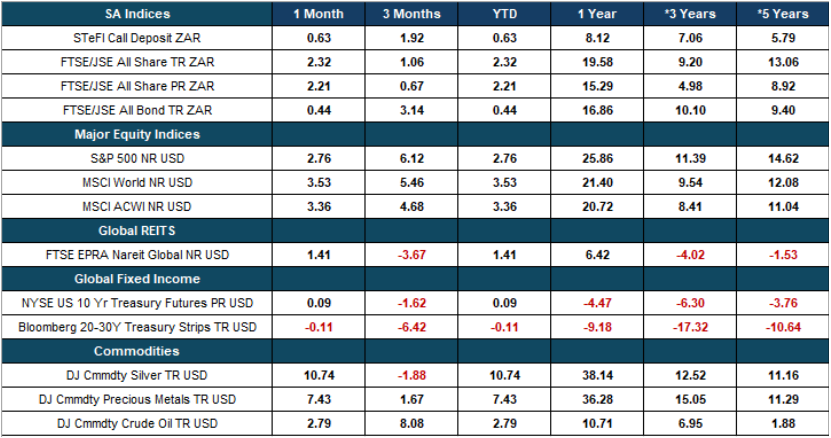

Asset Class Performance (Base Currency)