Market Insights

February was a month of significant market shifts, underscoring the importance of diversification and active management. Following a strong January, global equities faced headwinds as concerns over the implications of U.S. protectionist policies mounted. President Trump’s aggressive trade stance, particularly his proposed tariffs and focus on reshoring U.S. supply chains, stoked uncertainty about long-term economic growth. This uncertainty saw investors rotate away from high-valuation growth stocks into value-oriented sectors such as financial services, basic materials, and healthcare. The shift was evident in market performance, with the MSCI World Index declining by 2.15% while value stocks held up much better. Nine out of eleven market sectors outperformed the S&P 500, reinforcing this broadening trend.

February was a month of significant market shifts, underscoring the importance of diversification and active management. Following a strong January, global equities faced headwinds as concerns over the implications of U.S. protectionist policies mounted. President Trump’s aggressive trade stance, particularly his proposed tariffs and focus on reshoring U.S. supply chains, stoked uncertainty about long-term economic growth. This uncertainty saw investors rotate away from high-valuation growth stocks into value-oriented sectors such as financial services, basic materials, and healthcare. The shift was evident in market performance, with the MSCI World Index declining by 2.15% while value stocks held up much better. Nine out of eleven market sectors outperformed the S&P 500, reinforcing this broadening trend.

One of the most notable developments in February was the continued resilience of European and Chinese equities, highlighting the benefits of geographical diversification. European equities were among the strongest performers, with the MSCI Europe ex-UK Index rising 3.4%, driven by a combination of stronger-than-expected earnings, optimism around a potential Ukraine ceasefire, and robust performance in financials and defense-related stocks. Meanwhile, China surged ahead, with Chinese technology stocks delivering an eye-catching 11.7% gain in dollar terms. This was propelled by the ongoing success of DeepSeek, the Chinese AI firm that continues to challenge the dominance of U.S. tech giants. President Xi Jinping’s renewed push for economic growth and increasing signs of regulatory easing also bolstered sentiment, particularly in export-driven offshore Chinese markets.

On the fixed-income side, global bonds provided much-needed stability as U.S. sentiment indicators deteriorated. Despite inflationary concerns from Trump’s proposed policies, weakening U.S. economic confidence pushed Treasury yields lower, driving positive returns across global bond markets. The Bloomberg Global Aggregate Bond Index returned 1.4%, underscoring the defensive benefits of fixed income during equity market volatility. Emerging market debt, which benefitted from a weaker U.S. dollar earlier in the month, also provided some protection. February reinforced the importance of a diversified investment approach in an environment of shifting market leadership. Our active managers across value (Berkshire, Dodge & Cox), growth (T. Rowe Price, Scottish Mortgage), and quality (Nomura, Guinness) have demonstrated resilience and, in many cases, outperformed their respective style benchmarks. The introduction of Prescient China Balanced Fund aligns with our long-term view of maintaining style and geographical diversification not just across asset classes but across economic regions. With Trump’s protectionist trade stance set to reshape global supply chains and China’s AI sector emerging as a credible alternative to U.S. tech dominance, having exposure on both sides of this evolving economic landscape will be critical.

We remain committed to proactive, high-conviction portfolio adjustments to capitalize on these macro shifts while maintaining the discipline to focus on long-term fundamental drivers of value creation.

South Africa

February was marked by geopolitical uncertainty and shifting policy landscapes, both globally and domestically. South African markets navigated a challenging environment, with equities ending the month flat and bonds experiencing a mixed performance. Global market sentiment was dampened by U.S. economic and foreign policy uncertainty, leading to declines in U.S. equity indices, while South African investors remained focused on inflation, fiscal policy, and monetary dynamics.

The underperformance of U.S. equities (-1.3% S&P 500, -3.9% Nasdaq) weighed on global risk sentiment, while emerging markets outperformed slightly (+0.5% MSCI EM). European equities saw a resurgence, particularly in financials, benefiting from capital inflows and attractive valuations. U.S. Treasury yields fell (-33bps for the 10-year), reflecting concerns over economic growth rather than inflation, a shift that could influence South African monetary policy considerations. The dollar lost some ground, which provided mild relief to emerging market currencies, including the rand.

South African Asset Class Performance:

- Equities: The FTSE/JSE All Share Index ended the month unchanged, underperforming emerging market peers. Key stock movements included strong gains for Prosus (+11.6%) and Naspers (+12.3%), while the resources sector (-6.2%) weighed on the broader index following a stellar January performance (+17.9%). Financials were mixed, with banks (-1.1%) under pressure amid policy uncertainty.

- Bonds: South African bond yields rose for the third consecutive month, reflecting ongoing fiscal concerns and market skepticism regarding government reforms. Inflation-linked bonds (ILBs) outperformed (+1.0%) on seasonal inflation carry and heightened inflation expectations due to VAT hikes.

- Property: The listed property sector extended its year-to-date decline (-2.6%), despite strong gains for Growthpoint (+6.1%), Fairvest (+4.4%), and MAS (+2.4%). NEPI Rockcastle (-4.7%) underperformed due to weak forward guidance.

- Currency: The rand was relatively stable against the U.S. dollar (-0.2%), aided by a weaker dollar and moderate inflation expectations.

Economic Performance & Policy Developments:

- South African inflation rose to 3.2% (from 3.0% in December), aligning with forecasts. The increase was primarily due to base effects in fuel prices, which have seen consecutive monthly increases. Food inflation remains subdued (1.5%).

- Despite rising inflation, real interest rates remain positive, keeping the door open for SARB to cut rates further. Market pricing suggests a 75% probability of a 25bps rate cut in 1H25, with further easing expected later in the year, assuming stable global conditions.

- The postponement of the national budget created short-term uncertainty, particularly for bond investors. The delayed VAT increase proposal (2%) stirred inflation concerns but is unlikely to materialize in its current form. The key fiscal challenges remain economic stagnation, inefficient government spending, and a strained tax base.

The South African market remained resilient despite global volatility and domestic fiscal uncertainties. While inflation and monetary policy conditions remain favourable for potential rate cuts, structural economic challenges and fiscal constraints continue to weigh on the outlook. The coming months will be crucial as investors await clarity on budgetary reforms, energy security, and the trajectory of global risk sentiment

The Iza Portfolios

IZA Global Balanced Fund

The Iza Global Balanced Fund returned -1.41% in February, firmly in the top two quartiles for the month and ranking in the top quartile yearto-date vs both ASISA and EAA global peer group. The fund’s diversification across equities, bonds, and alternative assets once again proved its effectiveness in managing downside risk.

Key Contributors:

- Berkshire Hathaway (+8.05%): February was an exceptional month for Berkshire Hathaway, which hit an all-time high, crossing $750,000 per Class A share for the first time. The firm reported a staggering 71% increase in operating earnings for Q4 2024, fueled by strong performance in its insurance business, continued success in its energy holdings, and disciplined capital allocation by Warren Buffett and his team. Berkshire’s cash and equivalents balance also reached a record $334 billion, reflecting its cautious approach to valuations amid current market conditions. Additionally, Buffett’s latest annual letter reaffirmed his commitment to shareholder value, emphasizing a longterm perspective that has made Berkshire a cornerstone holding in our value allocation.

- U.S. Treasury Bonds (+1.21%): Declining yields in the U.S. bond market helped our Treasury positions generate solid gains, reinforcing the role of fixed income as a stabilizer.

- Rubrics Enhanced Yield Fund (+0.87%): This fund also benefitted from sovereign bond yields in the US moving swiftly lower due to increased concerns of possible slowdown due to Trump tariffs and continues to provide a reliable income stream for the balanced portfolio. This while also biding its time for growth slowdown to spill over into the credit space and allow for better entry into what is now historically tight credit spreads.

Strategic Portfolio Adjustments: Enhancing China Exposure

A key development in February was our decision to add Prescient China Balanced Fund to both Iza Global Equity and Iza Global Balanced. This was not a knee-jerk reaction but a well-considered move following extensive due diligence, including an on-the-ground physical visit of the team and offices based in Shanghai. The fund has consistently ranked in the top 25% globally among China-focused multi-asset funds and has significantly outperformed Chinese equity benchmarks such as the CSI 300 and Hang Seng over its more than 10 year history

Why Now?

- China has demonstrated a renewed commitment to stimulating economic growth, with pro-business policies, regulatory easing, and a sharp focus on AI development.

- China’s AI advancements are challenging U.S. dominance, with firms like DeepSeek gaining global traction.

- The fund’s unique investment approach diversifying across 200+ stocks while systematically adjusting equity exposure based on sentiment and valuation provides a risk-managed way to capture China’s recovery.

The benefits of this addition have already started to materialize, as Prescient China Balanced posted positive returns in February and accelerated further into March following strong market reception to President Xi’s pro-growth statements at the National People’s Congress.

Iza Global Equity Fund:

The Iza Global Equity Fund posted a return of -2.81% in February, slightly lagging the MSCI World Index (-2.15%). However, this slight underperformance was due to a timing anomaly, as a significant rally in U.S. markets on the final day of February was not fully reflected in our NAV calculations for a number of funds held until early March. As of March 6, this anomaly has normalized, and the fund has extended its year-to-date outperformance over the MSCI World to closer to 2%. This highlights the strength of our active manager selection and broad diversification across regions and styles.

Key Contributors:

- Berkshire Hathaway (+8.05%): As noted above, Berkshire was a standout performer, contributing meaningfully to the fund’s equity allocation.

- Dodge & Cox Global Stock Fund (-0.92%): Despite a slight negative return, this fund significantly outperformed both the MSCI World and major growth-focused equity funds. Its disciplined value approach, focused on financials, industrials, and healthcare, continues to provide stability in an environment where capital is rotating out of expensive mega-cap technology stocks.

- Guinness Global Equity Income Fund (-0.55%): This high-quality dividend-paying fund remained a strong performer, offering resilience amid market declines. Its focus on high-quality businesses with strong cash flow generation continues to be a source of stability in the portfolio.

Underperformers:

- Scottish Mortgage Investment Trust (-4.01%): February proved to be a tough month for the trust but not unexpected given the more than 35% rise the previous 12 months. This pullback was primarily due to declines in some of its largest growth holdings, including Amazon, which faced investor concerns over slowing growth. However, it wasn’t all bad news Meta, another top-five holding, outperformed other mega-cap tech names, helping offset some losses. Moreover, Scottish Mortgage’s aggressive share buyback strategy helped narrow its discount from 14.5% to 8.5%, a move that signals confidence in its underlying holdings. Importantly, Scottish’s exposure to AI innovation, including SpaceX, remains a key differentiator in the portfolio. This and the fund also has some exposure to high growth China players like Meituan , PDD and even Bytedance (Unlisted – products include short form video platform TikTok)

- Among the weaker performers were our growth-oriented holdings, including T. Rowe (-5.79%) and Nomura (-5.64%) both of which faced headwinds due to the broader market correction. However, also bore the brunt of the pricing anomaly discussed above with the last day rebound only coming through in March valuations. These both remain well-positioned given their long-term track records and historical ability to outperform in upcycles.

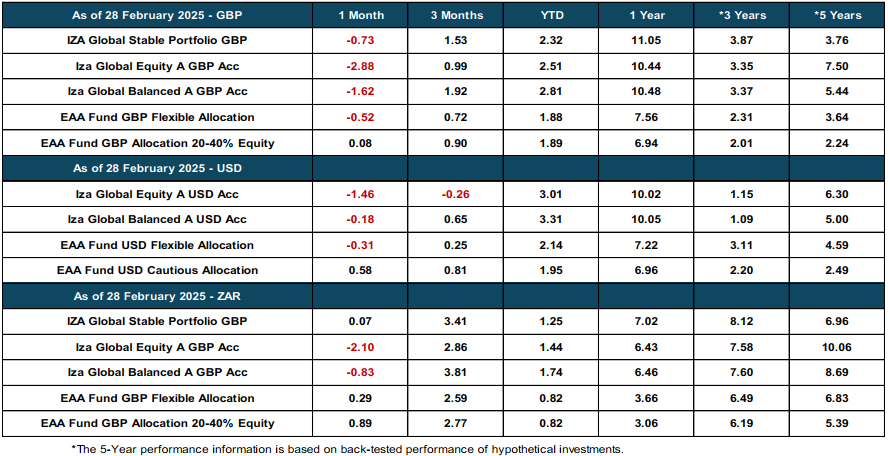

Asset Class Performance (Base Currency)