Market Insights

2024 was a year defined by exceptional returns in U.S. large-cap technology stocks and a resurgent U.S. dollar, particularly in Q4 following Donald Trump’s re-election. The U.S. economy maintained its strong momentum, with GDP growth averaging 2.6% annualized, driven by fiscal stimulus expectations and robust consumer spending. However, while the headline performance of developed markets was impressive, it masked significant underperformance in many segments of the market. Small- and mid-cap stocks, as well as value-oriented names, faced persistent challenges for much of the year, with only brief periods of reprieve in Q3 and early Q4.

2024 was a year defined by exceptional returns in U.S. large-cap technology stocks and a resurgent U.S. dollar, particularly in Q4 following Donald Trump’s re-election. The U.S. economy maintained its strong momentum, with GDP growth averaging 2.6% annualized, driven by fiscal stimulus expectations and robust consumer spending. However, while the headline performance of developed markets was impressive, it masked significant underperformance in many segments of the market. Small- and mid-cap stocks, as well as value-oriented names, faced persistent challenges for much of the year, with only brief periods of reprieve in Q3 and early Q4.

2024 was dominated by narrow market leadership, with U.S. large-cap technology stocks driving much of the gains. The “Magnificent Seven” AI stocks captured investor attention, raising questions about market breadth and the sustainability of such concentrated outperformance. Fixed income markets faced headwinds as yields remained elevated after brief sharp fall in Q3.

Looking ahead to 2025, the potential for market leadership to broaden presents opportunities for the Iza funds. Value stocks, mid-caps, and international equities may benefit from improved sentiment and policy support, particularly in regions like Europe and Japan. The Iza Balanced and Equity Funds are well-positioned to capture these shifts, thanks to their diversified holdings in growth, quality, and value strategies.

Despite elevated equity valuations in the U.S., both funds’ exposure to quality dividend-paying stocks, innovative growth companies, and defensive assets like gold and bonds ensures resilience against potential volatility. We remain vigilant in monitoring Trump’s fiscal and deregulation policies, geopolitical risks, and evolving market dynamics to capitalize on opportunities and maintain robust risk management.

Both the Iza Global Balanced and Equity Funds navigated this narrow market environment with a balanced and proactive approach allowing to capture significant portion of the upside without undue concentration risk. The decision to gradually increase USD exposure starting in September was well-timed, helping to cushion some of the impact of the dollar’s surge in Q4 more closely aligning both funds with their global peers. Despite the changes currency-related headwinds were a detracted in the final quarter.

The funds delivered robust performances for the year benefitting from strong contributions from core holdings in growth names, while fund selection added value in styles that lagged broader equities like value and quality-focused strategies.

South Africa

The South African equity market showed a slight decline of 0.3% in December but recorded a strong annual gain of 13.4%. Resource stocks underperformed due to declining commodity prices, particularly coal, while the retail, life insurance and banking sectors bucked the trend.

The rand weakened against the US dollar during December. That being said, much of this movement was driven by US dollar strength, as concerns over the implications of Trump’s potential second term as president unsettled currency and bond markets worldwide. SA bond yields ended higher; mirroring developed market yields. The All Bond Index (ALBI) recorded a negative return for December (-0.4%) but still finished the year with a strong positive performance of 17.2%. Inflation-linked bonds (ILBs) underperformed for the year despite marginal outperformance in December.

Inflation in South Africa rose to 2.9% in November, marking the sixth positive inflation surprise this year. Declining transport costs and slowed food inflation contributed significantly to the current low inflation rates, with expectations that these components will continue suppressing inflation early in 2025. The SARB however will have to weigh up the knock-on effect of higher import costs associated with a weaker ZAR (of late) against a relatively weak growth backdrop. Furthermore, the strong base effects in recent prints will begin to taper off early in 2025 which will be a consideration for market participants.

From a growth perspective, the local economy faced a contraction of 0.3% in Q3 2024, largely attributed to a severe 28.8% decrease in agricultural output due to drought conditions. Despite anticipated corrections in agricultural output, broader economic recovery remains subdued with mixed signals entering Q4 2024. Household and government consumption showed limited growth and contraction, respectively, with a slight positive swing in gross fixed capital formation.

As we conclude December 2024, it’s evident that South African markets mirrored the global trend of falling inflation and supportive monetary changes but at the same time showcased specific domestic dynamics worth noting. The biggest tailwind of course has been the change in leadership of SA with Government of National Unity which has alleviated the fear of leftist policies (typical of populist parties like the EFF and MK) and introduced a level of confidence not seen since early in the Zuma era. The major beneficiaries of this theme in the year were the banks, insurance companies and certain retailers. Outside of equities, bonds performed incredibly well despite weakness in the last quarter as US yields rose on the back of Trump’s election success.

Outside of the domestic sectors, there was a bifurcation in performance from the offshore or rand hedge counters with miners continuously on the backfoot (tracking commodity prices lower) while entities related to China like Richemont and Naspers benefitting from some improvement in earnings and also the uplift from stimulatory measures introduced by the government to aid consumers.

On aggregate it was a fruitful year for South African investors, with the average ASISA SA MA Low, Medium and High Equity funds returning 12.3%, 12.8% and 13.5% respectively. It was one of those years where just about all major asset classes contributed to returns, be it local or global. How well your investment performed depended on stock, sector and regional allocations where there were major differences.

All performance figures in ZAR unless otherwise stated.

The Iza Portfolios

IZA Global Balanced Fund

The Iza Global Balanced Fund outperformed its global peer benchmark (EAA Global Flex GBP) by 4% in 2024, finishing firmly in the top quartile. Its diverse portfolio, blending equities, bonds, and alternatives, was a key driver in delivering this strong performance.

Key Contributors:

• Berkshire Hathaway (+28% GBP): A standout performer across the entire portfolio, driven by strong operating results, cash flow growth, and share buybacks. The fund’s value-oriented resilience ensured it captured upside even in a growth-heavy market.

• Scottish Mortgage Investment Trust (+24% GBP): This growth-oriented trust bounced back from a tough year in 2022 and benefitted from strong performance in its private equity holdings, notably SpaceX, which received a significant tender offer boosted its valuation to USD 350 billion. The narrowing of the trust’s discount to its net asset value (NAV) further added to returns.

• SPDR Gold Trust (+30% GBP): Gold’s strong performance throughout the year was driven by central bank buying, heightened inflation fears, geopolitical tensions, and safe-haven demand, particularly during periods of heightened volatility.

The fund’s growth-focused manager T.Rowe Price Global Focused Growth (+19.91% GBP) capitalized on the ongoing strength in AI-related stocks and innovation-led sectors.

Nomura Global High Conviction (+14.68% GBP) delivered a respectable return, outperforming the majority of well-known quality focused peers, reinforcing its stock picking strength and robust risk management, avoiding a lot of pitfalls suffered by other quality fund names.

Value as a style suffered on a relative basis in 2024 and Dodge & Cox Worldwide Global Stock Fund (+6.95% GBP) was no different as it struggled to keep pace with the broader market given that the “Magnificent Seven” mega-cap tech stocks drove much of the index performance. Their top positions continue to trade at a significant discount to the general market. Despite this underperformance, the fund remains an essential diversifier, particularly as market breadth is expected to improve in 2025. The bond allocation also faced headwinds, with the iShares 7-10 Year Treasury Bond ETF (+0.3% GBP) and Rubrics Enhanced Yield (+2.79% GBP) was weighed down by a rise in yields in Q4. This was after a very positive Q3 that saw the US 10YR drop as low as 3.61%. The rise in rates was because of market pricing in a Trump win and associated policy stance, that prompted a steepening of the yield curve and fears of a recession that resurfaced in Q4 reversing all the gains made in Q3.

Nonetheless, bond holdings provide a steady income stream and served as a hedge as and when fears of economic slowdown took place throughout 2024.

In response the fund has proactively reduced some of its duration exposure and chosen shorter dated bonds to take advantage of the higher yields on offer.

The decision to exit Fundsmith Equity Fund in November was a prudent move as Fundsmith was once again impacted in December by a sharp 20% drop in Novo Nordisk, its second-largest holding. There is also concern additional investors start redeeming given the poor run which will result in them being forced to sell their holdings to fund redemptions, leading to further underperformance given their size.

IZA Global Equity Fund

The Iza Global Equity Fund delivered a strong double-digit return for 2024, although it lagged the MSCI World Index due to its more diversified and less concentrated approach. While the fund’s underweight to U.S. mega-cap technology stocks was a headwind, its inclusion of market and peer beating growth names meant that it still captured a large part of the upside while also reducing risk and providing a platform to capture the expected broadening of market gains in 2025.

Top Performers:

• Scottish Mortgage Investment Trust (+24% GBP): A key contributor to the fund’s performance, driven by SpaceX’s valuation uplift and the narrowing of the discount to NAV. The trust’s exposure to innovative private companies reinforced its resilience in a volatile year.

• Berkshire Hathaway (+28% GBP): Continued to demonstrate its strength as a core value holding, outperforming the broader market despite the dominance of growth stocks. This was achieved, all while building up more than 30% in cash and treasuries to buffer against the next possible downturn.

• S&P 400 Mid-Cap GARP ETF: The decision to replace Smithson with this ETF paid off immediately with large outperformance in November as Trump won the election, only to see some reversal in December.

As with the Balanced Fund growth holdings T. Rowe Price Global Focused Growth (+19.91% GBP) and the recent addition Guinness Global Innovators (+21.86% GBP), delivered consistent returns throughout the year.

The fund’s proactive increase in USD exposure helped offset some of the impacts of dollar strength in Q4 however the GBP weakness was still a key detractor on a relative basis. Finally, value holdings, such as Dodge & Cox Worldwide Global Stock Fund (+6.95% GBP) which, despite solid fundamentals and valuations struggled to match the performance of growth stocks.

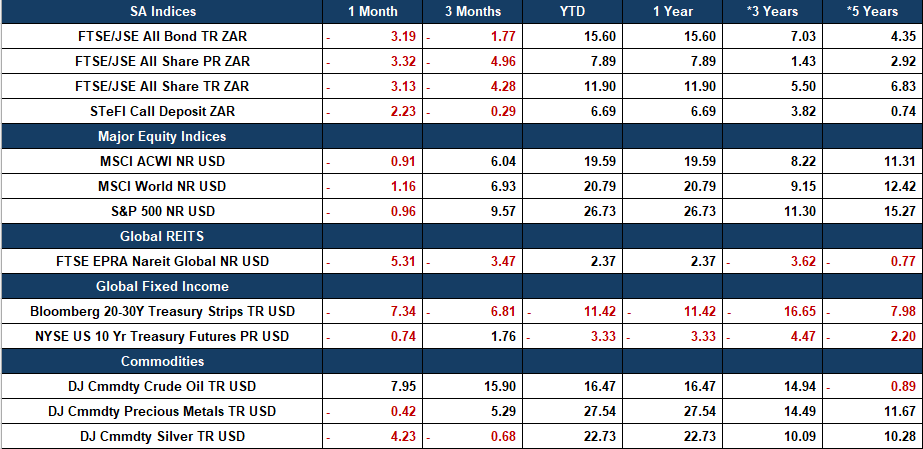

Asset Class Performance (Base Currency)